Disclaimer: All information in this article is accurate as of 01/12/22.

In 2020 and 2021 retail investing (investing performed by individual, non-professional investors) saw a surge in popularity. This was enabled by low fees and the popularity of trading platforms, especially geared towards retail investors. We won’t go into the basics of investing and assume you have a basic knowledge of how trading and the stock exchange work.

After searching ourselves we didn’t find a comprehensive guide focusing mainly on esports companies (to make things worse, the majority of instruments related to esports and gaming are filed in the ‘consumer discretionary’ sector).

So, if you’re a retail investor interested in investing in the esports industry, this guide provides an overview of companies you could consider trading with. However, we won’t be analyzing the performance or outlook of the companies mentioned in this piece.

Contents

ETFs

The first thing that anyone hears about when embarking upon an investing journey is an ETF.

ETF stands for Exchange-Traded Fund and is basically a ‘basket’ of different companies, which are then pooled and traded as a single stock. (For physical-based ETFs; we won’t be talkling about SWAP-based ETFs, which hold derivatives of underlying assets).

Using simple words ‘ if you want to buy 10 different kinds of flowers (where each individual flower represents a stock of a different company), you would go from florist to florist and buy a number of each different flower, and hold them together. You individually decide how many flowers of each you want to buy and hold (x roses, y tulips etc.) based on your preference. But, let’s say there comes a florist who offers a pre-made bouquet, which features a number of different flowers and offers to sell the bouquet as a unit, so you don’t have to go around and purchase each flower individually. The only downside is that the contents of the pre-made bouquet are set and you can’t change them. This analogy is similar to how ETFs work.

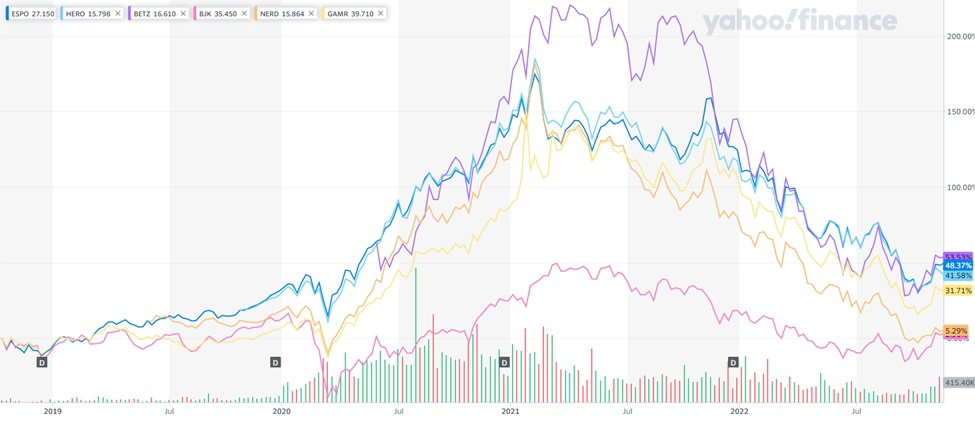

ETFs are a good starting point for an individual investor as they offer a degree of diversification (spreading your investment over different assets ‘ the ‘don’t put all your eggs in a single basket’ principle). Also, as mentioned previously, they offer easier purchase of multiple companies at once. One downside of industry-specific ETFs is that they are all concentrated on one industry, and so will most likely move in the same direction (e.g., if the gaming industry falters, the ETFs fall too, as all companies inside them are gaming-related.) So, bear in mind that esports and gaming ETFs are not well diversified and will share the fate of the gaming industry overall (as opposed to ETFs that track more industries).

Key ETFs we’ll be mentioning are as follows:

Symbol | ETF Name | Tracking Index | ISSUER LINK

- ESPO: VanEck Video Gaming and eSports ETF | MVIS Global Video Gaming & eSports | ISSUER LINK

- HERO: Global X Video Games & Esports ETF | Solactive Video Games & Esports Index | ISSUER LINK

- BETZ: Roundhill Sports Betting & iGaming ETF | Roundhill Sports Betting & iGaming Index | ISSUER LINK

- BJK: VanEck Gaming ETF | MVIS Global Gaming | ISSUER LINK

- NERD: Roundhill Video Games ETF | Nasdaq CTA Global Video Games Software Index | ISSUER LINK

- GAMR: Wedbush ETFMG Video Game Tech ETF | ISE EEFund Video Game Tech Index | ISSUER LINK

Before investing in any instrument, we strongly suggest analyzing the ETF’s holdings and respective industries. You can check what each ETF consists of by searching a prospectus or the homepage of the ETF’s issuer.

For example, let’s say you buy 1 share of NERD ETF ‘ that would mean that you’ve invested 17.94% in Nintendo stocks, 11.42% in Electronic Arts and 5.79% in Take-Two Interactive etc. (as of November 24 2022).

Basically, by investing in ETFs you invest in the sector, industry, country etc, that they cover.

Just to give an overview of the close match between these gaming ETFs, the graph below shows all these ETFs plotted together:

Source: Yahoo Finance. (This interactive chart can be found at: https://tinyurl.com/gamingetfcompared, source: Yahoo Finance)

Finally, this is not an exhaustive list of ETFs related to gaming and esports, as new funds could be created at any time. Especially given the potential overlap between industries (e.g., Corsair Gaming could be considered as both part of esports and gaming industries).

Individual stocks

The majority of the ETFs above are more ‘gaming’ than ‘esports’. What we mean by that is that they don’t hold ‘pure’ esports companies; mostly because they are rather small compared to big players in the gaming industry (Electronic Arts, Take Two, Tencent, etc.). We classify ‘pure esports’ companies as the ones that own and operate at least one esports team, either directly or through directly owned subsidiaries. If you wish to compile a portfolio of these pure esports companies, we present them below. Bear in mind that the vast majority of esports companies are still privately held (not listed on any exchange).

Enthusiast Gaming Holdings Inc

Basic Information

| Ticker | EGLX (TSX:EGLX) |

|---|---|

| Main stock exchange | Toronto Stock Exchange |

| Founded | 2014 |

|---|---|

| Website | www.enthusiastgaming.com |

Note: Alongside each company we mention the primary stock exchange of trading (all companies can be traded on multiple stock exchanges, i.e. EGLX is traded on TSX and NASDAQ), to avoid confusion if there are similar tickers (e.g. if you search for just ‘GILD’ you will probably encounter company Gilead Sciences with the same ticker).

Enthusiast Gaming is a Canadian company engaged in digital media, predominantly video game journalism. Besides gaming journalism, Enthusiast Gaming directly owns several esports teams ‘ Vancouver Titans (Overwatch League), Seattle Surge (COD league), and Luminosity Gaming, which competes in a variety of esports titles (Apex Legends, Rocket League, PUBG etc.).

EGLX share price in the last 12 months (in CAD)

Source: CapitalIQ.

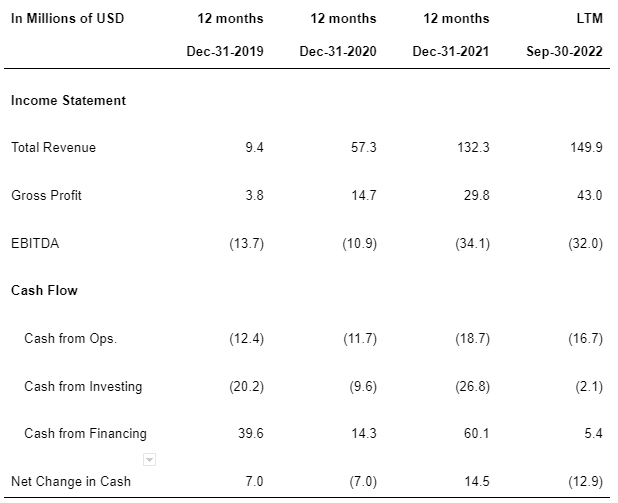

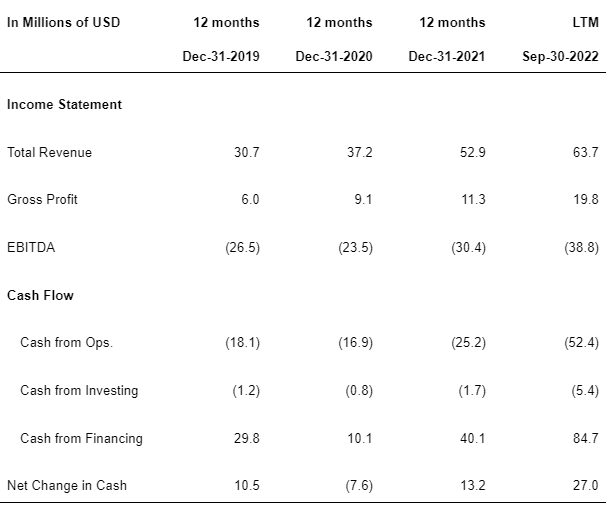

EGLX selected financial items

Source CapitalIQ

Gamesquare Esports Inc

Basic Information

| Ticker | GSQ (CNSX:GSQ) |

|---|---|

| Stock exchange | Canadian Securities Exchange |

| Founded | 1997 |

|---|---|

| Website | www.gamesquare.com |

Gamesquare is a gaming and esports company that owns a wide variety of companies including the digital media group Gaming Community Network and representation agency CodeRed. Gamesquare directly owns Complexity Gaming, after an all-stock acquisition in 2021 (reported transaction value was USD 27 million). Complexity fields rosters across several esport titles (CS:GO, FIFA, Apex Legends, Fortnite, Rocket League, etc.).

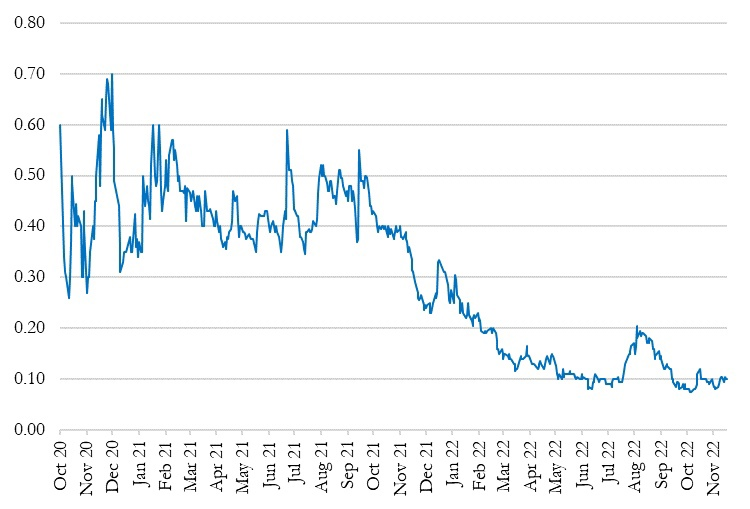

GSQ share price in the last 12 months (in CAD)

Source: CapitalIQ.

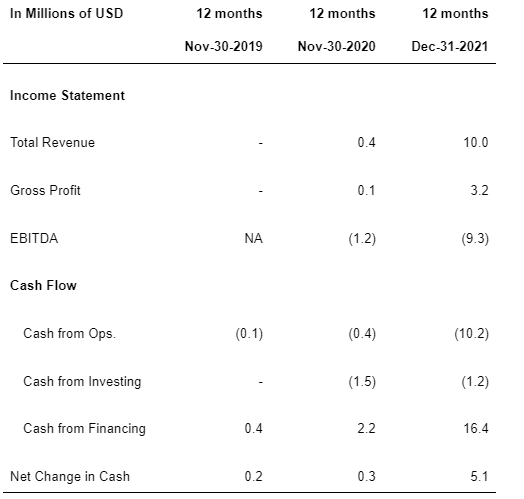

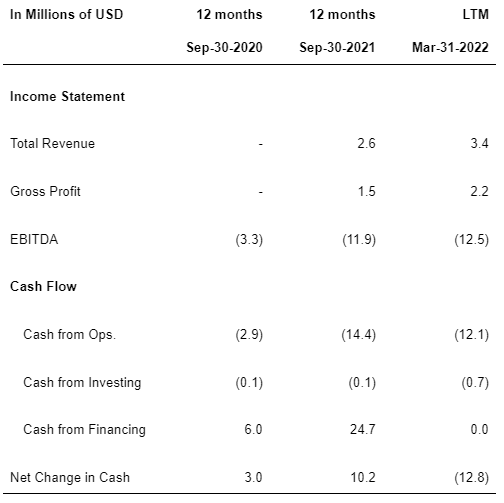

GSQ selected financial items

Source: CapitalIQ.

FaZe Holdings Inc

Basic Information

| Ticker | FAZE (NASDAQ:FAZE) |

|---|---|

| Stock exchange | NASDAQ |

| Founded | 2010 |

|---|---|

| Website | www.fazeclan.com |

FaZe Holdings Inc. operates a lifestyle and media platform in gaming and youth culture. The company produces content, designs merchandise and consumer products, as well as creating advertising and sponsorship programs. Faze is directly involved in a number of different esport titles including CS:GO, COD, Fortnite, PUBG, Rainbow 6, Valorant, Rocket League etc.

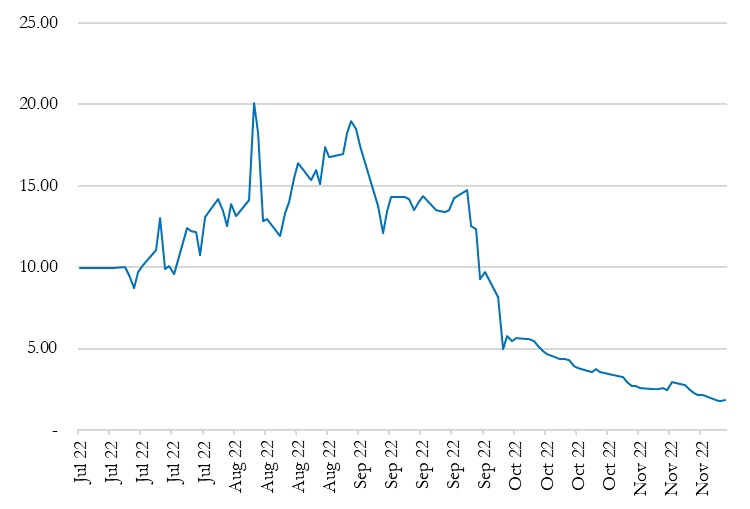

FAZE share price in the last 12 months (in USD)

Source: CapitalIQ.

FAZE selected financial items

Source: CapitalIQ.

Guild Esports Plc

Basic information

| Ticker | GILD (LSE:GILD) |

|---|---|

| Stock exchange | London Stock Exchange |

| Founded | 2019 |

|---|---|

| Website | www.guildesports.com |

Guild Esports is an esport company fielding rosters in Valorant, Fortnite, Rocket League and FIFA. Guild states their strategy is developing an esports team through a UK-based talent pipeline for esports athletes, based on the traditional sports academy model.

GILD share price in the last 12 months (in GBP)

Source: CapitalIQ.

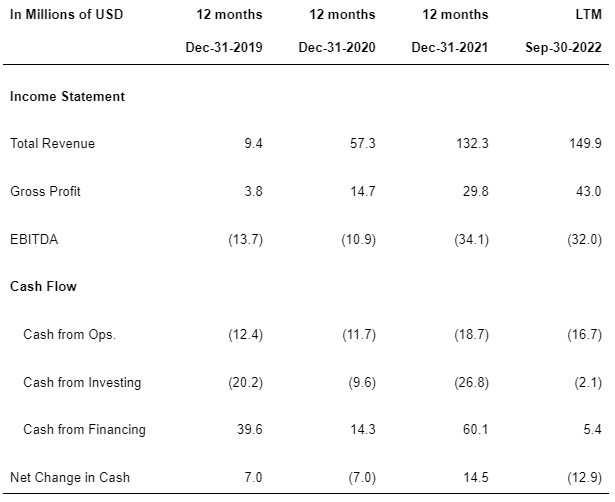

GILD selected financial items

Source: CapitalIQ.

Astralis A/S

Basic information

| Ticker | ASTRLS (CPSE:ASTRLS) |

|---|---|

| Stock exchange | Copenhagen Stock Exchange |

| Founded | 2016 |

|---|---|

| Website | www.astralis.gg |

Astralis A/S operates esports companies competing in CS:GO, Rainbow 6, League of Legends, Fortnite and FIFA. In December 2019, Astralis was listed on Nasdaq First North Growth Market, becoming the first publicly listed team owner in esports. In addition to their esport teams, Astralis acquired Pixel.tv, Danish production house.

ASTRLS share price in the last 12 months (in GBP)

Source: CapitalIQ.

ASTRLS selected financial items

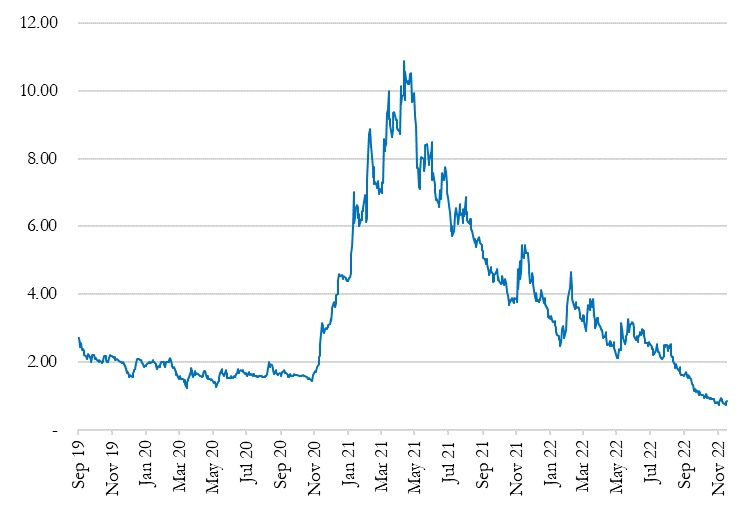

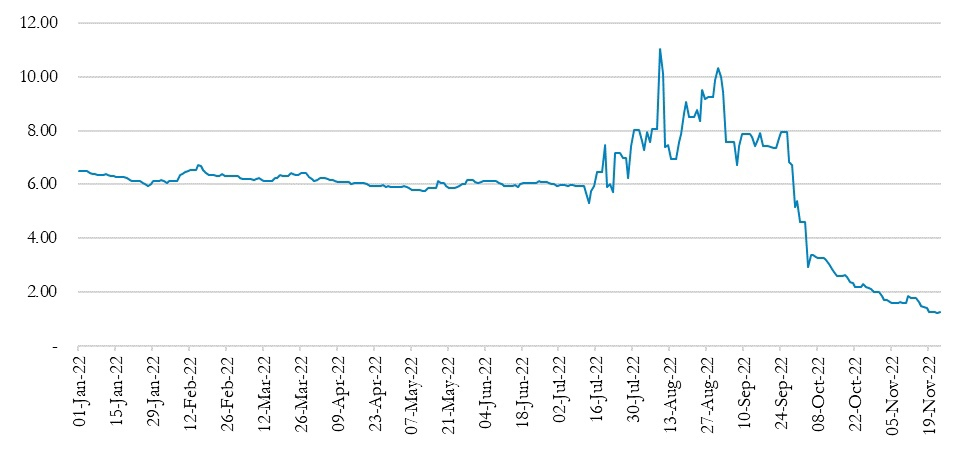

Blix Esport Companies Index and closing remarks

As we mentioned, there’s no ETF/Index that tracks only pure esport companies, so we decided to create our own for illustrative purposes ‘ Blix Esport Companies Index (BECI); comprising the five companies we’ve mentioned above, weighted by their market capitalization. The perceived relative stability of the index in the period before July 2022 is due to no trading of Faze stock prior to this period (Faze outweighs all companies per market capitalization and is hence ‘pulling’ the index mostly towards its market price). In the future we may revise the index, lowering the weight of Faze stock to lower the influence this stock has on the overall index.

We wanted to give you an overview of which companies are listed on stock exchanges, so you can own a piece of them. As we mentioned, the majority of esport companies are privately held, and many received significant venture capital investment in the past couple of years. Furthermore, Fnatic gathered additional capital through their crowdfunding campaign, a process through which they sold a minor part of their equity, but remained a private company.

We still believe the esport market is very volatile and as such might not be suitable for risk-averse investors.

Disclaimer

Disclaimer: This article is for informational purposes only, you should not construe any information from this article or other material as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer by Blix.gg or the author to buy or sell any securities or other financial instruments.